Calgary – Are Buyers and Sellers Disconnected?

With news media reporting that the economic recession in Calgary is behind us, it appears that sellers are expecting more for their high-value properties. However, while these neighbourhoods typically command higher prices due to their estate nature and desirability, they are currently selling at a large discount.

Calgary – Are Buyers and Sellers Disconnected?

Economic analysis suggests the recession is behind us and there are signs of improvement. That may be somewhat true but there are still headwinds, especially in residential real estate.

The Bank of Canada raised its key policy interest rate twice in 2017 once in July and again in September. Additionally, building off reforms implemented in October 2016, the Federal Government announced additional tightening to home buyer lending policies toward the end of 2017. Although announced near the end of 2017, the new policies didn’t take effect until the new year. As a result, Albertans were motivated to complete sales ahead of the announced policy tightening. This led to a flurry of resale housing activity, with over 5,000 sales in December.

According to the Calgary Real Estate Board, first quarter sales totaled 3,423 units, nearly 18 per cent below last year’s levels and 24 per cent below long-term averages. Inventories are elevated heading into what would normally be considered the spring selling season. Said CREB® chief economist Ann-Marie Lurie. “We are entering the most active quarters in the housing market with more inventory, which could create some price fluctuations. However, the improving economy is expected to prevent overall prices from slipping by significant amounts.”.

Leading Calgary realtors are advising sellers to be realistic about pricing expectations because it is not the same market that it was 3 or 4 years ago.

Well, what does that mean anyway?

Perhaps we might consider the effects of deepest recession in Alberta in decades in terms of the effects on the Calgary metropolitan detached luxury market.

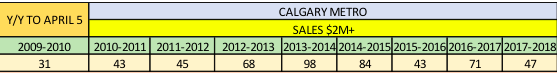

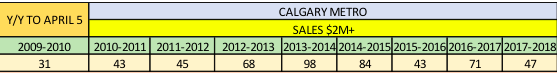

In terms of sales over $2,000,000 encompassing year over year sales to April 5, 2018 there were 47 transactions, down significantly from the yearly period prior at 71 and not so different from the levels recorded in the periods following the Global Economic Meltdown of 2008-2009.

So, transactions are down significantly, but how has this affected price levels?

Overall statistics can tell a story, but real estate is local by nature and all segments of the market are not affected in the same way.

One way appraisers use to measure price changes over time is re-sale analysis. The current sales price of a property is compared to its previous sales price. An extensive analysis would be undertaken to ensure that all facets of the property are highly similar and that the difference in price is due to changes in market conditions alone.

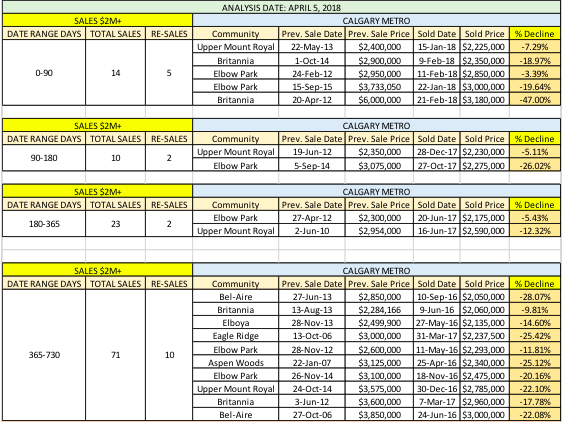

Consider the following re-sales:

The neighborhoods in which upper end transactions took place are not unusual in the Calgary context. These neighborhoods typically command higher prices due to their estate nature and desirability.

In the above sample, all properties indicated a lower price currently than when they were acquired. Most properties in the sample illustrate a significant decline in value.

The discount ranged from 3.39% to a 47%. It should be noted that the upper end of this range was set by a property sold in foreclosure and is not considered typical for analysis purposes. More typically, the median discount was in the range of 19%.

Now let’s put that in a dollar perspective. 19% of say $3,000,000 is $570,000. It is certain that none of these sellers anticipated they would lose this amount of real money when they originally purchased the property.

On the supply side, as of the time of writing, there were 90 active listings in Calgary with an asking price exceeding $2,000,000. Remember, there were only 47 sales of such properties in the last full year. 90 active listings represents nearly two years of supply at current sales velocities.

Take Aways?

Economic analysis suggests the recession is behind us and there are signs of improvement. That may be somewhat true but there are still headwinds, especially in residential real estate.

The Bank of Canada raised its key policy interest rate twice in 2017 once in July and again in September. Additionally, building off reforms implemented in October 2016, the Federal Government announced additional tightening to home buyer lending policies toward the end of 2017. Although announced near the end of 2017, the new policies didn’t take effect until the new year. As a result, Albertans were motivated to complete sales ahead of the announced policy tightening. This led to a flurry of resale housing activity, with over 5,000 sales in December.

According to the Calgary Real Estate Board, first quarter sales totaled 3,423 units, nearly 18 per cent below last year’s levels and 24 per cent below long-term averages. Inventories are elevated heading into what would normally be considered the spring selling season. Said CREB® chief economist Ann-Marie Lurie. “We are entering the most active quarters in the housing market with more inventory, which could create some price fluctuations. However, the improving economy is expected to prevent overall prices from slipping by significant amounts.”.

Leading Calgary realtors are advising sellers to be realistic about pricing expectations because it is not the same market that it was 3 or 4 years ago.

Well, what does that mean anyway?

Perhaps we might consider the effects of deepest recession in Alberta in decades in terms of the effects on the Calgary metropolitan detached luxury market.

In terms of sales over $2,000,000 encompassing year over year sales to April 5, 2018 there were 47 transactions, down significantly from the yearly period prior at 71 and not so different from the levels recorded in the periods following the Global Economic Meltdown of 2008-2009.

So, transactions are down significantly, but how has this affected price levels?

Overall statistics can tell a story, but real estate is local by nature and all segments of the market are not affected in the same way.

One way appraisers use to measure price changes over time is re-sale analysis. The current sales price of a property is compared to its previous sales price. An extensive analysis would be undertaken to ensure that all facets of the property are highly similar and that the difference in price is due to changes in market conditions alone.

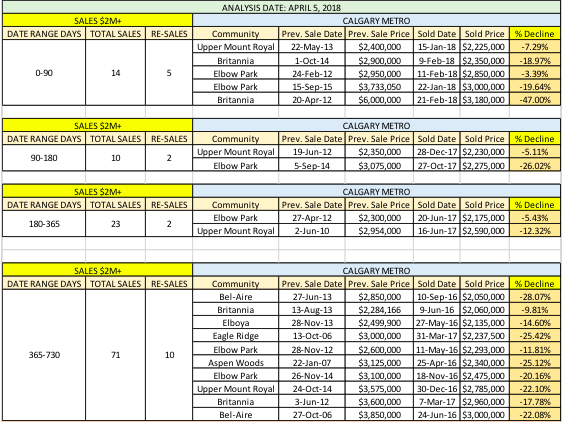

Consider the following re-sales:

The neighborhoods in which upper end transactions took place are not unusual in the Calgary context. These neighborhoods typically command higher prices due to their estate nature and desirability.

In the above sample, all properties indicated a lower price currently than when they were acquired. Most properties in the sample illustrate a significant decline in value.

The discount ranged from 3.39% to a 47%. It should be noted that the upper end of this range was set by a property sold in foreclosure and is not considered typical for analysis purposes. More typically, the median discount was in the range of 19%.

Now let’s put that in a dollar perspective. 19% of say $3,000,000 is $570,000. It is certain that none of these sellers anticipated they would lose this amount of real money when they originally purchased the property.

On the supply side, as of the time of writing, there were 90 active listings in Calgary with an asking price exceeding $2,000,000. Remember, there were only 47 sales of such properties in the last full year. 90 active listings represents nearly two years of supply at current sales velocities.

Take Aways?

- Realtors are advising potential sellers to be realistic in their price expectations

- Sellers need to understand the realities of the current market

- Buyers have a great deal of choice

- Now, more than ever, market participants need to be properly informed to make educated decisions

- Many market participants search for zero cost market information believing that gives them all they need. Is that really due diligence?

blog comments powered by Disqus